Online platform for accounting outsourcing company

Background

Customer Request

Challenges & Solutions

Challenges

Errors in the project's technical organization

The basic website with the system was maintained only on demand, without regular updates or monitoring. This made client interactions harder and disrupted the workflow of the consulting company's specialists.

Lack of automation for interaction with financial institutions

Half of the specialists’ work involved dealing with financial institutions, slowed down by manual data handling and routine tasks like gathering access details and account info — all of which hurt team productivity.

Shortage of databases systematization for various clusters

The consulting company's work was hindered by scattered data across Excel and Google Sheets. This led to data loss, complicated analytics, and made scaling impossible due to the overload of unprocessed information.

Solutions

Streamlining technical processes and project redesign

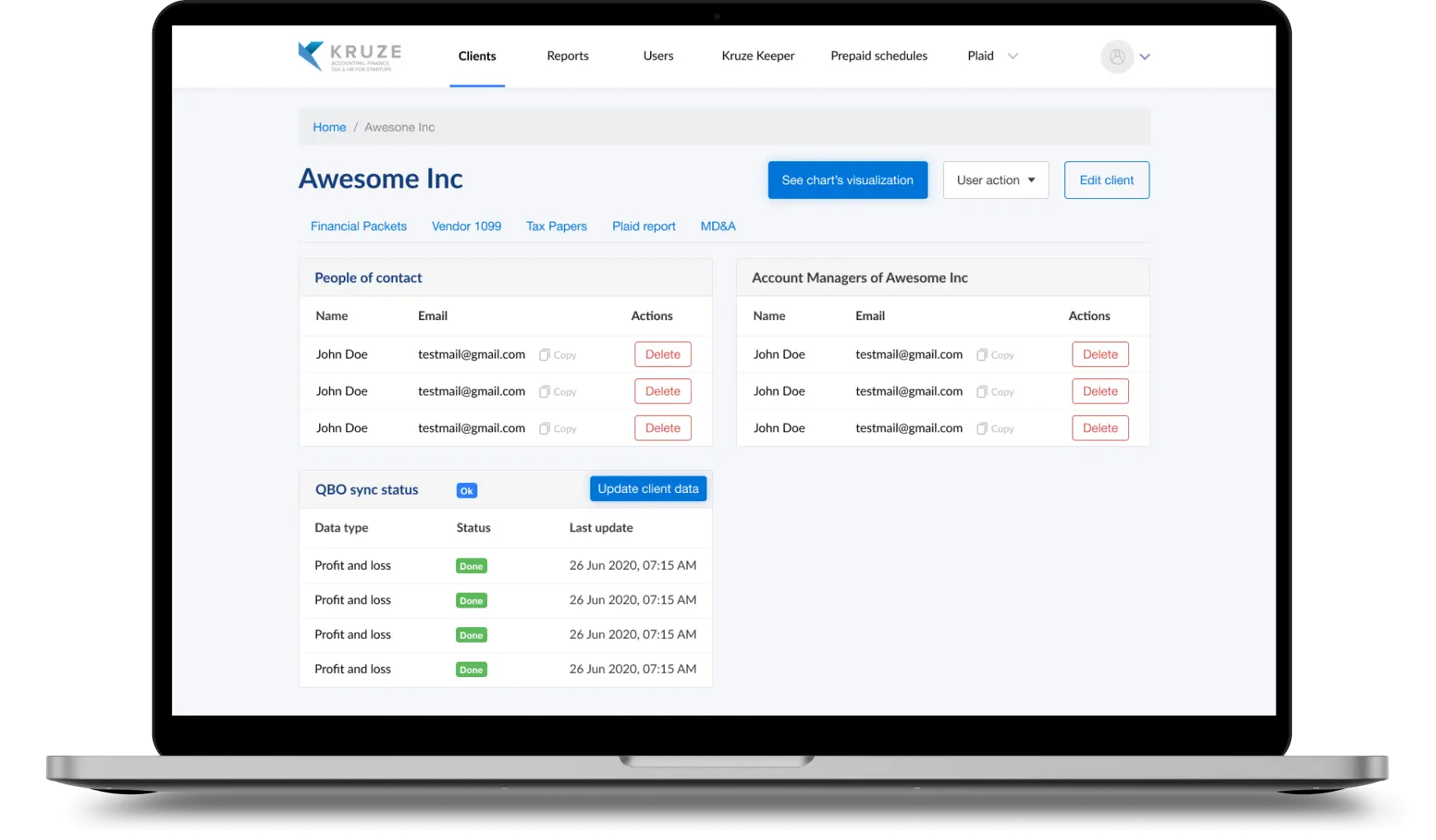

To streamline customer interactions and boost Kruze specialists’ efficiency, we built a task system for developers. The updated platform was fully systematized by clients, requests, services, and user access, both technically and visually.

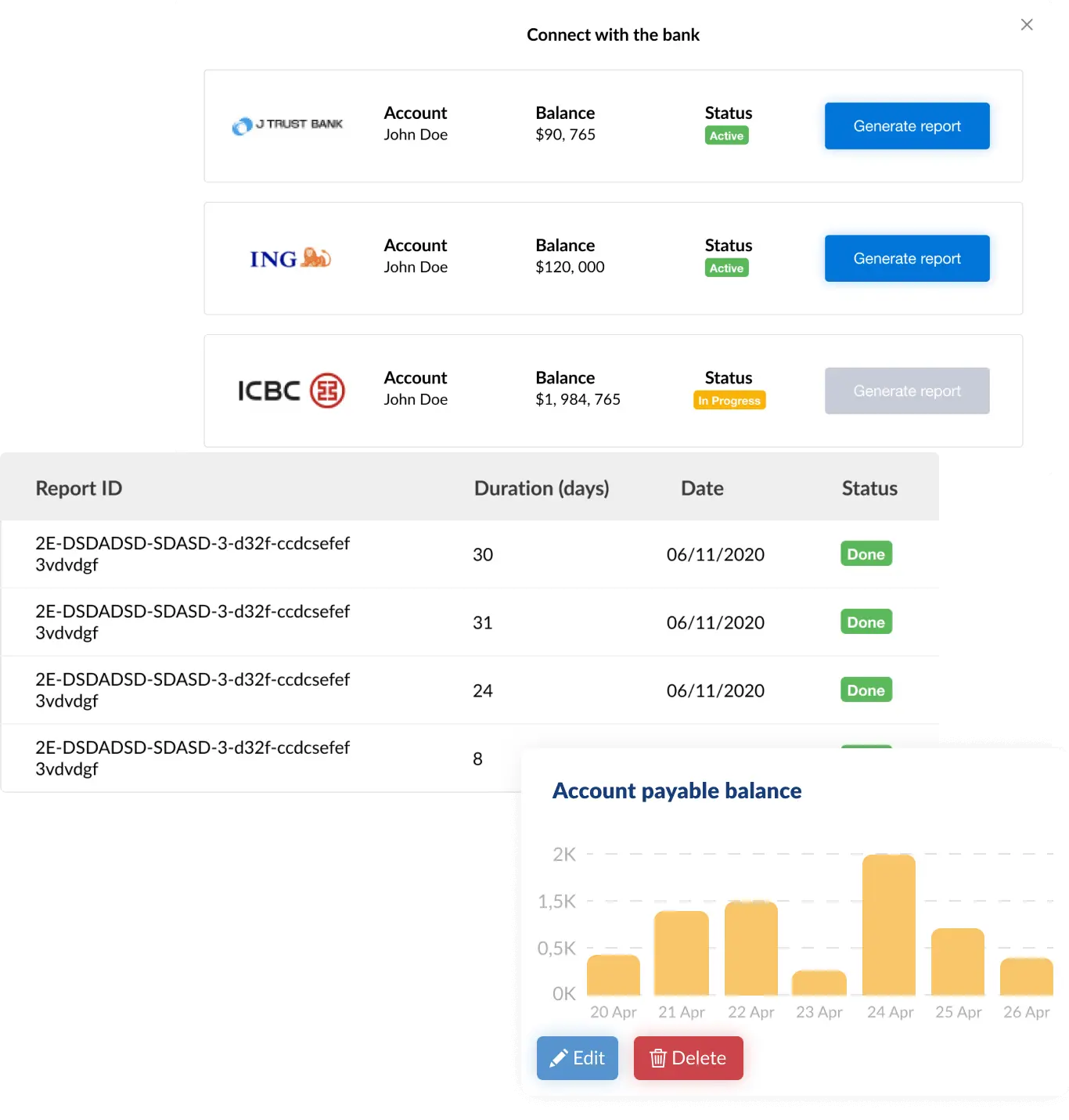

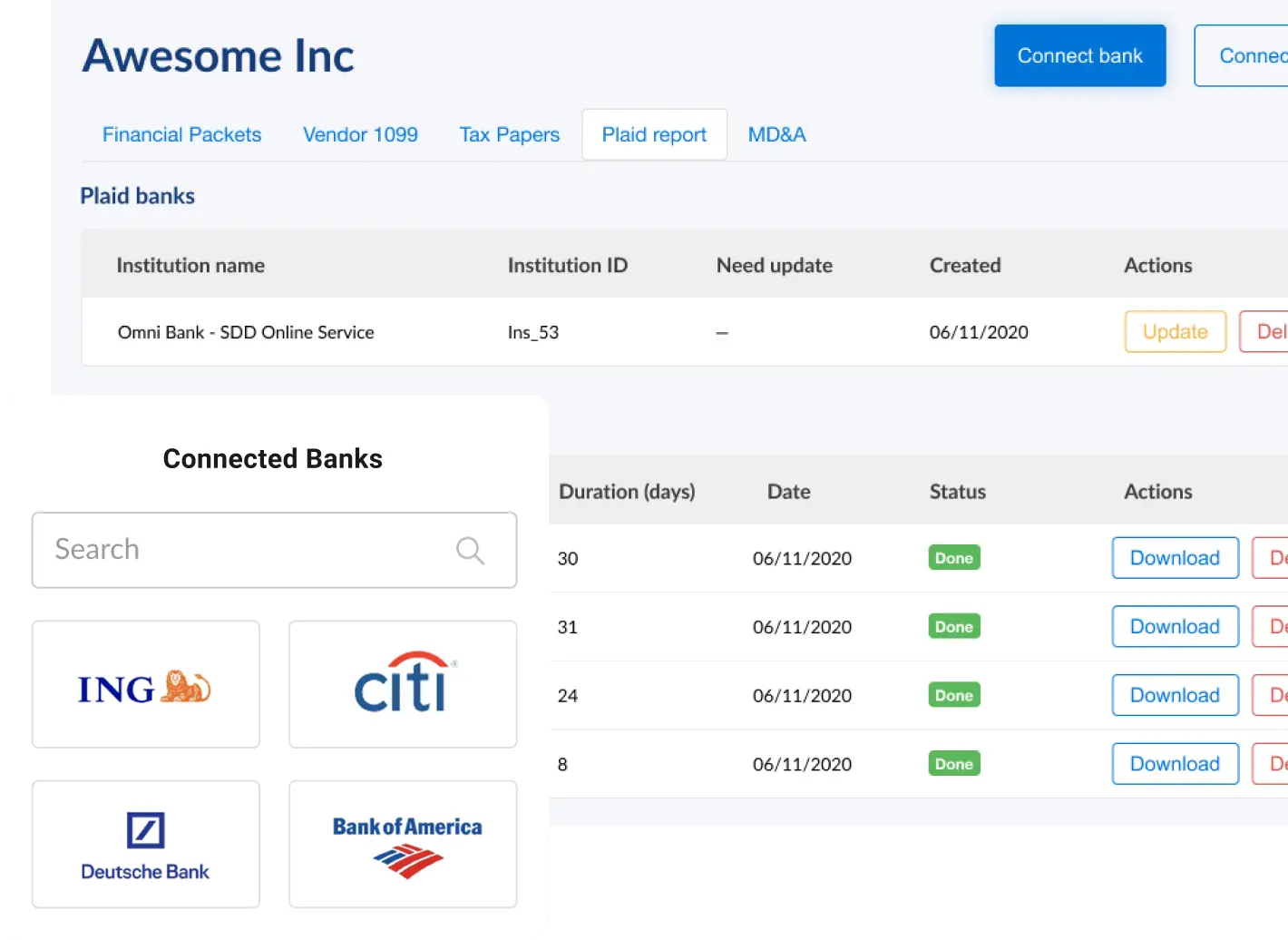

Development of functionality for simplified interaction with banks

FTL specialists integrated banking interfaces for direct access to payment tools from the system. This sped up financial transactions and reduced errors caused by the human factor.

Creating a clustered database

By introducing a user database with clustered information, the company streamlined data processing for analytics and forecasting within one system. At the same time, data security improved thanks to access restrictions.

project facts

main features

Financial Package Development

Earlier, the company’s specialists spent a lot of time creating personalized monthly financial reports for every individual client. Design of the generation function of such documents with data import from QuickBooksOnline allowed automating the preparation process of Financial Package for every separate company with an automatic mailing that significantly decreased the operational time of accountants and analytics of Kruze.

Financial reporting system

Most of the financial documentation was previously prepared by specialists manually, relying on figures and data from various documents, reports, invoices and other sources of financial information. We implemented the customer cards cross-integration with the ability to view all data directly in the card and export it to the necessary reports. It allowed us to optimize the work system maximally. At the same time, the company significantly reduced the risk of errors in documentation due to the human factor, thereby fully protecting clients from fines and itself from losing cooperation contracts.

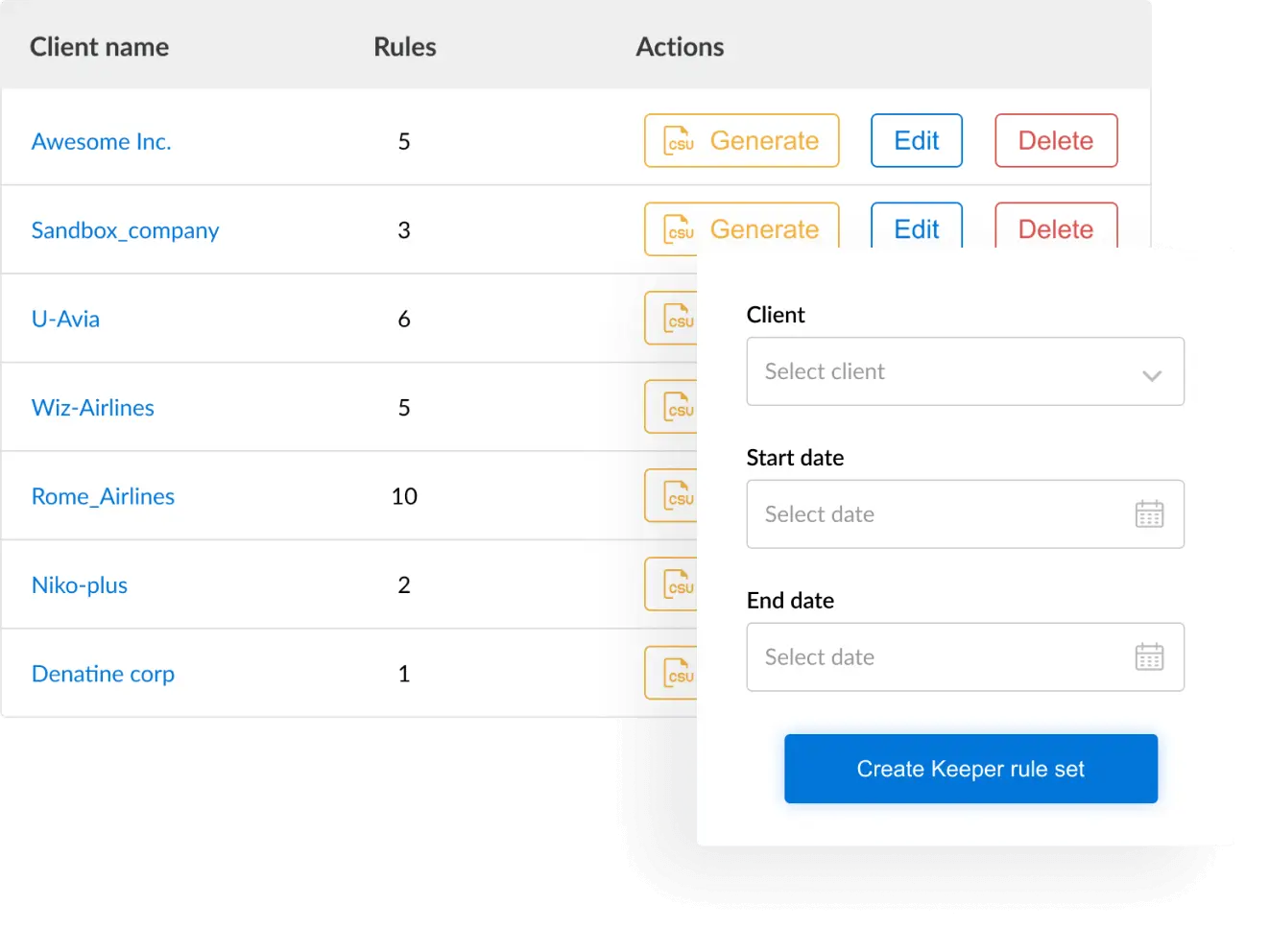

Formation of the unified database for identification and analytics of financial information

Tracing and keeping transactions for every individual start-up is one of the most routine tasks in bookkeeping management. Creation of the unified library of identification rules from QuickBooks allowed for optimizing tracing financial flows for every specific account. Library Kruze Keeper comprises and is continuously supplemented with rules with assigned key requests ranked by success rate for every separate vendor. The development algorithm of new rules includes an assessment of the availability of similar rights, their rating, and other parameters. Kruze Keeper’s development permitted to automation of accounting and registration of transactions and significantly reduced the time for their tracing.

Technologies used